Table of Content

If you meet all of these tests, you can choose to either fully deduct the points in the year paid, or deduct them over the life of the loan. The points were figured as a percentage of the principal amount of the mortgage. Payments made to end the lease and to buy the lessor's entire interest in the land aren't deductible as mortgage interest. In some states , you can buy your home subject to a ground rent. A ground rent is an obligation you assume to pay a fixed amount per year on the property. Under this arrangement, you're leasing the land on which your home is located.

Fill out only one Table 1 for both your main and second home regardless of how many mortgages you have. Figure your share of this interest by multiplying the total by the following fraction. Has no stockholders who can receive any distribution out of capital other than on a liquidation of the corporation.

Tax Benefits on a Second Home Loan

Deductions under Section 80C are offered on the payment basis – deductions can only be claimed on the actual amount the borrower pays in a year. On purchase of property with home loans, borrowers enjoy a variety of deductions on their income tax liability. These deductions against the tax could be claimed under four sections of the income tax act, namely Section 80C, Section 24, Section 80EE and Section 80EEA.

Where To Deduct Your Interest Expense Worksheet to figure , Table 1. Home loan taken on your self-occupied property is what I meant first housing loan. The repayment of the loan amount or interest paid there off is eligible for income tax rebate for this self occupied property. The amount paid as repayment of the principal amount of home loan is allowed as deduction under the section 80C of the Income tax Act subject to the maximum limit of Rs 150,000.

More Under Income Tax

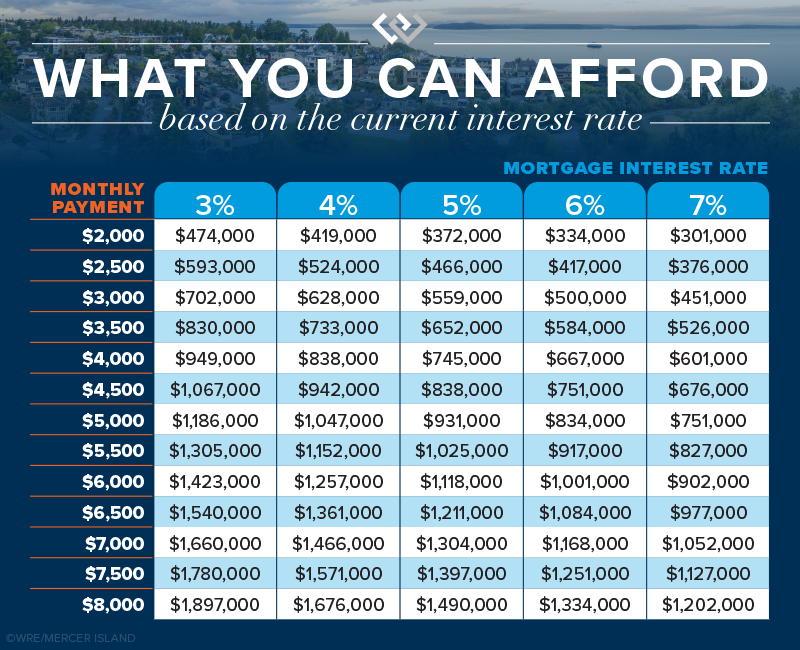

On July 15, you took out a mortgage of $150,000 secured by your main home. You can treat the mortgage as taken out to buy your home because you bought the home within 90 days before you took out the mortgage. The entire mortgage qualifies as home acquisition debt because it wasn't more than the home's cost. A mortgage secured by a qualified home may be treated as home acquisition debt, even if you don't actually use the proceeds to buy, build, or substantially improve the home.

This deduction on interest payment is available, for any residential or commercial property owned by you. It is also available whether the money is borrowed from a bank/housing company, or from your friends and relatives. The deduction for interest, can only be claimed from the year in which the possession is taken. So, for an under construction, the interest paid during the construction period cannot be claimed prior to completion of construction. It can be amortised and claimed in five equal instalments, beginning from the year in which the construction is completed and possession of the house is taken. 1.Enter the average balance of all your grandfathered debt.

Deductions under Section 80EEA

Yes, you can claim separate deductions in your IT returns if your spouse is employed and has a separate source of income. You can both claim deduction under Section 80C up to Rs.1.50 lakh from your total income. If the house is jointly owned, each co-owner can claim deductions up to Rs.2 lakh on account of the interest on borrowed money. In case of self-occupied house property, since the gross annual value is nil, claiming the deduction on home loan interest will result in a loss from house property. As per income tax law, maximum Rs 2 lakh loss from all self-occupied properties can be adjusted against income from other heads. Because the home is considered a business, you can deduct rental expenses, including mortgage interest, property taxes, insurance costs, property manager fees, utilities, and property depreciation.

In addition, you can deduct any points paid by the seller. The buyer reduces the basis of the home by the amount of the seller-paid points and treats the points as if he or she had paid them. If all the tests under Deduction Allowed in Year Paid, earlier, are met, the buyer can deduct the points in the year paid. If any of those tests aren't met, the buyer deducts the points over the life of the loan.

But, before opting for second home, one should keep in mind the tax implications under the income tax act 1961 of the second home. If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes . If the home is considered an investment property , you can deduct expenses related to owning, maintaining, and operating the property.

However, the amount of your grandfathered debt reduces the limit for home acquisition debt. If you took out a mortgage on your home before October 14, 1987, or you refinanced such a mortgage, it may qualify as grandfathered debt. To qualify, it must have been secured by your qualified home on October 13, 1987, and at all times after that date. The mortgage interest statement you receive should show not only the total interest paid during the year, but also your mortgage insurance premiums and deductible points paid during the year.

Interest Rs.50,000 80EE For loan amount of up to Rs.35 lakh and for property value of up to Rs.50 lakh. Principal Rs.1.5 lakh 80C Sale of property should not be done before 5 years of possession is completed. Stamp Duty Rs.1.5 lakh 80C Should be claimed in the same financial year as it was spent. If you sell your house within 5 years after possession, any deduction claimed will be reversed in the year in which you sell it.

If you pay interest in advance for a period that goes beyond the end of the tax year, you must spread this interest over the tax years to which it applies. You can deduct in each year only the interest that qualifies as home mortgage interest for that year. However, there is an exception that applies to points, discussed later. If you're married filing separately and you and your spouse own more than one home, you can each take into account only one home as a qualified home. However, if you both consent in writing, then one spouse can take both the main home and a second home into account.

In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee for eligible taxpayers. To find an LITC near you, go to TaxpayerAdvocate.IRS.gov/about-us/Low-Income-Taxpayer-Clinics-LITC or see IRS Pub.

No comments:

Post a Comment